Determining the Right Amortization Period

20th Jan 2017

If you’re in the market for a new home in 2017, at some point you’re going to wrestle with your mortgage amortization period. Canada has shortened the amortization period over the years but your mortgage broker can show you how this may benefit you.

It’s easy to confuse the mortgage amortization period with the term of the mortgage. The amortization period is the total length of time it will take you to pay off your mortgage. The mortgage term is the length of time you commit to a mortgage rate and lender.

If your down payment on a house is less than 20% your maximum amortization period is 25 years. A mortgage with less than 20% down is a high-ratio mortgage and must carry mortgage default insurance. The insurance protects the lender in the case of default. Because of the high-risk nature of this type of mortgage the amortization period limit is 25 years.

The minimum down payment on a home is 5%. With a 5% down payment, you would have a maximum amortization period of 25 years.

If your down payment is greater than 20% of the purchase price you don’t need mortgage default insurance and you can secure a conventional mortgage. The maximum amortization period is up to 30 years.

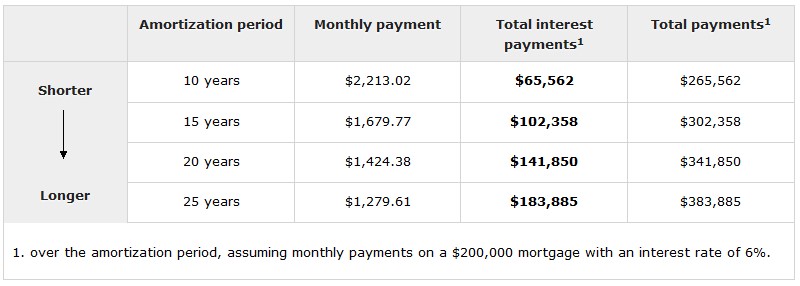

The amortization period can greatly affect the overall amount you pay for you home. The table below from the Financial Consumer Agency of Canada shows how a change in the amortization period affects payments.

Shorter amortization periods save you money because you pay less in interest costs over the life of the mortgage. With fewer payments you build equity in your home faster and you pay the mortgage off sooner. Monthly payments are higher.

With longer amortization periods, you pay more interest over the life of the loan but monthly payment amounts are lower. You may be able to afford more home because your payments are lower. You build equity in the home at a slower pace and it takes longer to own the home.

Another benefit of a longer amortization period of the cash flow it frees up. The difference between a 20-year mortgage and a 25-year mortgage may be around $200 a month. If you have something productive to do with the extra money the longer amortization period may make sense.

You don’t have to stay with the amortization period you select when you apply for the mortgage. You can always choose to shorten the amortization period at a later date. Shortening the amortization period saves you money on the amount of interest you pay. You can also make extra payments or choose an accelerated payment option. The main point is you always have options.

Vertuity Mortgage can present you with amortization schedules showing you how the mortgage term and amortization rate can work together to get you the right mortgage. Obviously, there’s wide range of options. Your Vertuity Mortgage broker will work with you to determine the right mortgage for you based on your individual needs.